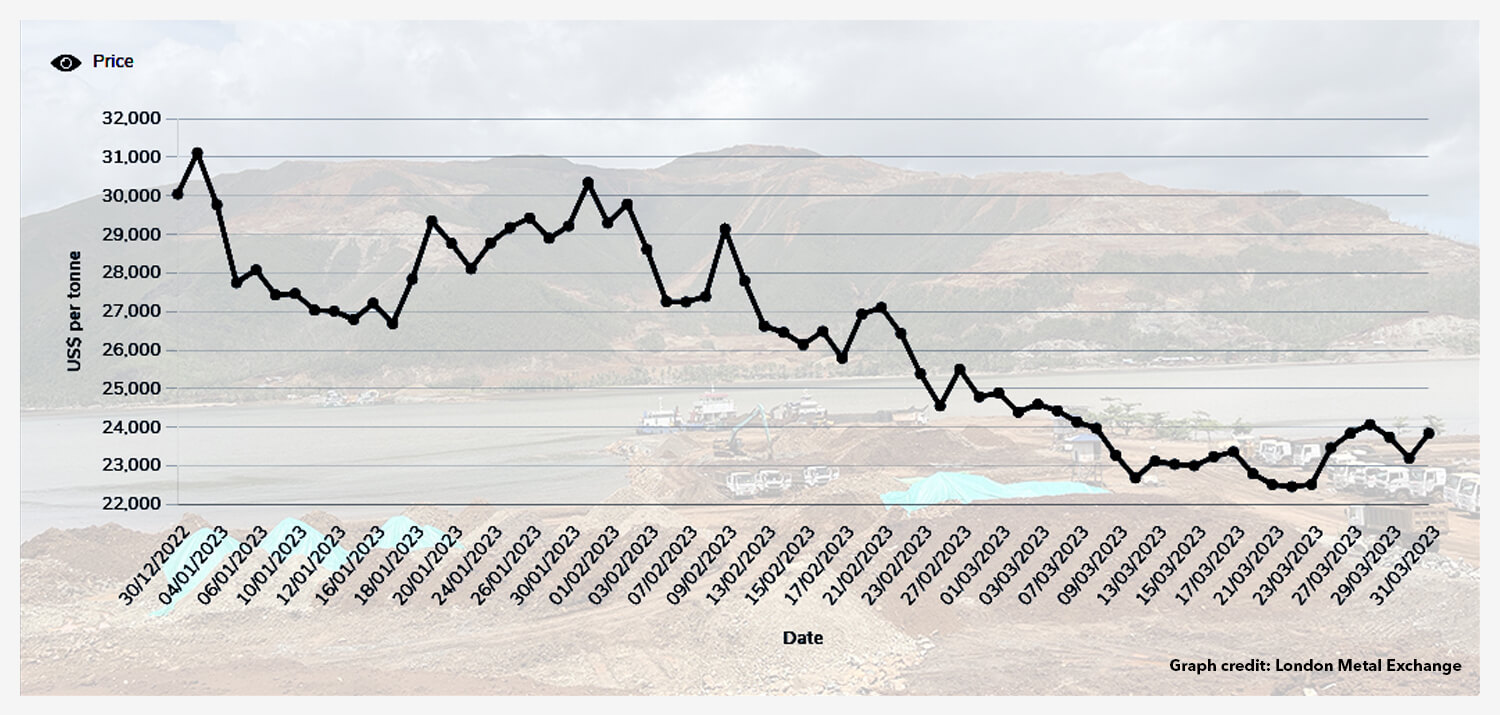

Based on the platform London Metal Exchange (LME), the trend as to the performance of nickel prices declined in the first three months of the year 2023. As shown in the graph, there was a big drop of approximately 23.39% in the prices from US$31,118 per metric ton (MT) on the 3rd day of January 2023 to US$23,838 per MT on the last day of March 2023.

The LME is a world center for the trading of industrial metals.

Some of the observed factors considered in the decrease of the nickel prices are as follows:

- Increasing supply from Indonesia coupled with a slower-than-forecast demand rebound from China that hit the market in the first quarter, which created a slowdown at a time when the industry is still recovering from the year 2022 LME meltdown. (The LME nickel meltdown is attributed to Russia’s invasion of Ukraine in February 2022 which sparked a period of chaos in the nickel market, exposing the vulnerabilities of the exchange.)

- In Europe and North America, stainless steel production has been tepid at best, and scrap utilization rates have been high, reducing the demand for primary nickel products.

- There are the high and rising interest rates, which make everyone cautious about buying or investing in industrial metals assets and products.

With the said factors, the industrial sector which includes the mining sector is expected to continuously experience uncertainty and instability in the nickel prices towards the rest of the year.

Sources:

• LME Nickel | London Metal Exchange

• Nickel Price Update: Q1 2023 in Review (investingnews.com) by Priscila Barrera

• Why the Nickel Meltdown on the LME Still Matters: QuickTake - Bloomberg by Mark Burton and Jack Farchy

• LME Nickel | London Metal Exchange

• Nickel Price Update: Q1 2023 in Review (investingnews.com) by Priscila Barrera

• Why the Nickel Meltdown on the LME Still Matters: QuickTake - Bloomberg by Mark Burton and Jack Farchy